Is It Easy To Withdraw Money From Robinhood

Summary

Recommended for beginners and buy-and-hold investors focusing on the US stock market

Robinhood is a US-based, zero-fee discount broker established in 2013. The company is regulated by top-tier financial authorities, such as the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

Besides the brokerage service, Robinhood also introduced Cash Management to help clients earn interest on uninvested funds. Click here for more details on this great and unique service.

BrokerChooser is committed to bringing high transparency and clarity to its customers, including brokers and partners. BrokerChooser's Advertiser Disclosure.

Robinhood published recently its S1 disclosure. If you're interested in analyzing Robinhood's business numbers and how they stack against up other brokers, check this report.

Best free stock trading platform Best app for stock trading

We selected Robinhood as Best free stock trading platform and Best app for stock trading for 2021, based on an in-depth analysis of 70+ online brokers that included testing their live accounts. Check out the complete list of winners.

Robinhood pros and cons

Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. Its mobile and web trading platforms are user-friendly and well designed. Account opening is seamless, fully digital and fast.

On the downside, Robinhood provides only a limited selection of assets, focusing mostly on the US market. Customer support is available via e-mail only, which is sometimes slow. The educational material lineup is slim.

| Pros | Cons |

|---|---|

| • Free US stock and ETF trading | • Limited product range |

| • Great mobile and web trading platforms | • Weak customer support |

| • Fast and fully digital account opening | • Few educational materials |

| 🗺️ Country of regulation | USA |

| 💰 Trading fees class | Low |

| 💰 Inactivity fee charged | No |

| 💰 Withdrawal fee amount | $0 |

| 💰 Minimum deposit | $0 |

| 🕖 Time to open an account | 1 day |

| 🎮 Demo account provided | No |

| 🛍️ Products offered | Stock, ETF, Options, Crypto |

Robinhood review

Fees

To find out more about its trading and non-trading fees, visit Robinhood

Compare to its best reviewed alternative: SoFi Invest

Trading US stocks and ETFs is free at Robinhood. The broker doesn't charge an inactivity or withdrawal fee.

| Pros | Cons |

|---|---|

| • Commission-free US stock and ETF trading | None |

| • No fee for deposit or withdrawal | |

| • Transparent fee structure |

| Assets | Fee level | Fee terms |

|---|---|---|

| US stock | Low | Stock and ETF trading is free |

| EURUSD | - | Not available |

| Mutual fund | - | Not available |

| Inactivity fee | Low | No inactivity fee |

How we ranked fees

We ranked Robinhood's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

First, let's go over some basic terms related to broker fees. What you need to keep an eye on are trading fees and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

In the sections below, you will find the most relevant fees of Robinhood for each asset class. For example, in the case of stock investing the most important fees are commissions.

We also compared Robinhood's fees with those of two similar brokers we selected, SoFi Invest and Webull. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of Robinhood alternatives.

To have a clear overview of Robinhood, let's start with the trading fees.

Robinhood trading fees

Does Robinhood have fees? Robinhood charges zero commissionfor US stock, options and crypto trading.However, Robinhood provides further services which are not free of charge.

Stock fees and ETF fees

At Robinhood, you can trade US stocks (and ETFs) free of charge, which undeniably saves you a lot of money.

| Robinhood | SoFi Invest | Webull | |

|---|---|---|---|

| US stock | $0.0 | $0.0 | $0.0 |

In addition to US stocks and ETFs, you can also trade several foreign stocks through ADRs. ADRs incur small custody fees (usually 1 to 3 cents per share) that get passed on to customers.

If you want to trade stocks on margin, you'll need to open a Gold account.A margin rate is charged when you trade on margin. This basically means that you borrow money or stocks from your broker to trade. You will have to pay interest on this borrowed money. This can be a significant proportion of your trading costs.

Robinhood's margin rates are lower than its peers' but a bit higher than those charged by Interactive Brokers (IBKR), which is 1.6%.

| Robinhood | SoFi Invest | Webull | |

|---|---|---|---|

| USD margin rate | 2.5% | - | 7.0% |

The margin rate is calculated as follows: there is a monthly $5 fixed fee (for the Gold account, which is practically a margin account) but there is no annual charge if you use margin up to an amount of $1,000. If you use a margin above $1,000, there is an additional 2.5% annual charge on the amount exceeding $1,000. Your interest is calculated daily and charged to your account at the end of each billing cycle.

Options fees

Similarly to stocks, options trading is also commission-free.

| Robinhood | SoFi Invest | Webull | |

|---|---|---|---|

| US stock index options | $0.0 | - | $0.0 |

Crypto fees

Robinhood now offers free crypto trading in almost all US states.

Non-trading fees

Robinhood has low non-trading fees.There are no withdrawal or inactivity fees.

| Robinhood | SoFi Invest | Webull | |

|---|---|---|---|

| Account fee | No | No | No |

| Inactivity fee | No | No | No |

| Deposit fee | $0 | $0 | $0 |

| Withdrawal fee | $0 | $0 | $0 |

If you would like to transfer assets out from Robinhood, a transfer fee of $75 will be charged.

Robinhood withdrawal fee

Robinhood doesn't charge a fee for ACH withdrawals. However, wire transfers are expensive: the price tag of a domestic wire transfer is $25 and you will have to pay $50 for international wire withdrawals.

Robinhood review

Account opening

To experience the account opening process, visit Robinhood

Compare to its best reviewed alternative: SoFi Invest

The account opening at Robinhood is seamless, fully digital and can be completed within a day. On the negative side, the broker only accepts US clients and IRA accounts are not available.

| Pros | Cons |

|---|---|

| • Fast | • Available only for US clients |

| • Fully digital | • No IRA accounts offered |

| • No minimum deposit |

Can you open an account?

Visit broker

Currently, only US citizens are allowed to open an account. However, Robinhood is planning to make its services available to clients in Europe and other continents as well. In a significant step toward this goal, Robinhood has already received a brokerage license in the UK from the Financial Conduct Authority (FCA). It's unclear when they start the launch, the original expectation was 2020.

What is the minimum deposit at Robinhood?

There is no minimum depositfor the Robinhood Instant account.

If you upgrade to theRobinhood Gold account, you have to deposit a minimum of $2,000.

Account types

If you sign up, you automatically open a Robinhood Instant account. You can, however, convert your account to a Cash Account or upgrade to Robinhood Gold. The latter comes with a $5 monthly fee. Some of the extra features they provide for this fee (Morningstar research, more margin available) are short of being special and are usually included in the free 'package' at other US brokers.

Individual Retirement Accounts (IRA) are not available at Robinhood.

| Cash Account | Robinhood Instant Account | Robinhood Gold | |

|---|---|---|---|

| Advantages | + Day trading is not limited by Pattern Day Trading rules | + Instant deposit up to $1,000 + Limited margin account, meaning immediate access to proceeds from stock sales (i.e. you can reinvest those funds in other stocks, ETFs, and options without having to wait up to 3 days for settlement) | + Instant deposit up to $50,000 + It's a true margin account, giving you more buying power + No interest on the first $1,000 of margin debt + Live market data (NASDAQ level II) + Additional research tools, like recommendations from Morningstar |

| Disadvantages | - No instant deposit, money transfer takes 4-5 days - Not a margin account, therefore it involves slow settlement (meaning you need to wait for days after a sale to be able to use the proceeds) | - Day trading is limited by Pattern Day Trading rules | - Day trading is limited by Pattern Day Trading rules - $5 monthly fee |

One major difference between the different accounts is the limitation on day trading as per Pattern Day Trading rules. This is important when you buy and sell a stock on the same day and have an account balance of less than $25,000.

With the Robinhood Instant and Robinhood Gold accounts, you can performonly three day trades per week. If you do more, your account will be blocked for 90 days unless you have a balance of at least $25,000.Although the Cash Account doesn't have such constraints, day trading is virtually impossible considering that you need to wait 3 days for settlement after selling to use the proceeds.

Another key differentiator is buying power (margin). This allows you to trade with money borrowed from the broker, and you have to pay interest on the margin amount. Robinhood Gold allows 2:1 leverage. Other account types don't allow trading on margin.

Thirdly, the accounts have different instant deposit limits.

How to open your account

The account opening process is user-friendly, fast and fully digital. It takes around 10 minutes to submit your application and less than a day for your account to be verified.

Opening a Robinhood account in the US requires that you

- are 18 or older

- have a valid social security number

- have a legal US residential address

- are a US citizen, US permanent resident, or have a valid US visa

To complete the Robinhood account opening:

- Fill in your personal information (i.e. address, date of birth and social security number)

- Answer short questions relating to your trading experience

- Verify your identity with yourdriver's license / identity card / passport. A photo of the documents taken with your mobile will do.

Robinhood review

Deposit and withdrawal

To find out more about the deposit and withdrawal process, visit Robinhood

Compare to its best reviewed alternative: SoFi Invest

Deposit and withdrawal at Robinhood are free and easy and a great cash management service is available. On the other hand, you can use only bank transfer and deposits above your 'instant' limit may take several business days.

| Pros | Cons |

|---|---|

| • Free withdrawal | • Credit/Debit card not available |

| • No deposit fee | • Depositing larger amounts on Robinhood Gold takes longer |

| • Cash management service | • Wire withdrawal is pricey |

Robinhood introduced a great Cash Management service, which can earn interest on your uninvested cash.

Deposit fees and options

Robinhood deposits are free of charge. However, you can use only bank transfer.

| Robinhood | SoFi Invest | Webull | |

|---|---|---|---|

| Bank transfer | Yes | Yes | Yes |

| Credit/debit card | No | No | No |

| Electronic wallets | No | No | No |

If you use the instant deposit option, your money arrives immediately; otherwise, the process may take 4 to 5 business days. The instant deposit function has some limitations: if you have a Robinhood Instant account, you can deposit up to $1,000 instantly, while the Robinhood Gold account limit is $50,000. All transfers above the set limit will be credited after 4 to 5 business days. For example, if you transfer $1,500 to your Instant account, $1,000 will be credited immediately, while the remainder after 4 to 5 business days.

You can only deposit money from accounts in your name.

Robinhood withdrawal fees and options

Robinhood doesn't charge a fee for ACH withdrawals. However, wire transfers are expensive: the price tag of a domestic wire transfer is $25 and you will have to pay $50 for international wire withdrawals.

| Robinhood | SoFi Invest | Webull | |

|---|---|---|---|

| Bank transfer | Yes | Yes | Yes |

| Credit/debit card | No | No | No |

| Electronic wallets | No | No | No |

| Withdrawal fee | $0 | $0 | $0 |

How long does it take to withdraw money from Robinhood? Withdrawal usually takes 3 business days. There is a withdrawal limit of $50,000 per day, and if you deposit money but don't use it for trading, you can only withdraw it after 5 business days.

You can only withdraw money to accounts in your name.

Stock transfer

You can transfer stocks in or out of your account. Incoming stock transfers are free, while outgoing transfers cost $75 per transaction.

Cash Management

Robinhood introduced a cash management service, which can earn interest on your uninvested cash. At the time of the review, the annual interest was 0.30%.

Besides earning interest, you have access to other useful services:

- Get Mastercard debit card issued by Sutton Bank

- Use the cash for paying bills or any purchases

- Free withdrawal from ATMs if you choose an Allpoint or MoneyPass ATM

The uninvested cash is deposited with banks that are FDIC-insured, i.e. you are protected up to $250,000. Keep in mind that the deposits held in the same bank in another way than Robinhood's Cash Management are also included in the total cash protection limit of max. $250,000.

The banks where Robinhood holds the uninvested cash at the time of the review are: Goldman Sachs, HSBC, Wells Fargo, Citibank, Bank of Baroda, U.S. Bank.

To apply for the Cash Management service, you have to sign up for a waitlist.

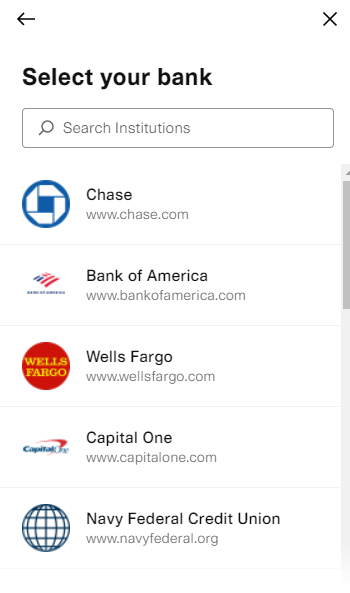

How to withdraw money from Robinhood?

- Tap the Account icon in the bottom right corner.

- Tap Transfers.

- Tap Transfer to Your Bank.

- Choose the bank account you'd like to transfer to.

- Enter the amount you'd like to transfer to your bank.

- Tap Submit.

Compare to other brokers

Want to stay in the loop?

Sign up and we'll let you know when a new broker review is out.

Robinhood review

Web trading platform

To try the web trading platform yourself, visit Robinhood

Compare to its best reviewed alternative: SoFi Invest

Robinhood provides a safe, user-friendly and well-designed web trading platform. On the downside, customizability is limited.

| Pros | Cons |

|---|---|

| • User-friendly | • Limited customizability (for charts, workspace) |

| • Clear fee report | |

| • Two-step (safer) login |

| Trading platform | Score | Available |

|---|---|---|

| Web | 4.5 stars | Yes |

| Mobile | 5.0 stars | Yes |

| Desktop | - | No |

Disclaimer: Robinhood's system crashed three times between 03 March and 09 March 2020, its clients were unable to log in and/or trade in volatile market conditions. This review and its score don't reflect these incidents yet. We think such downtimes have a temporary effect, therefore we did not update the respective scores in the broker review. If you happen to experience another outage at this (or any) broker, contact us at [email protected].

Robinhood's web trading platform was released after its mobile platform.

Look and feel

The web trading platform is very easy to use and itprovides great user experience.

You can't customize the platform, but the default workspace is well designed, clear and logically structured.

Login and security

Robinhood provides a two-step login, which is safer than using only a username and password.

Search functions

The search functions are greatin that you will always find the assets you are looking for. You can do a simple search in the search bar, or search based on tags. If you click on a stock, you can see some related tags under the 'Collections' tab (e.g. the name of the sector where the company is active). If you click on a tag, you will see all stocks that share the same tag. It is a helpful feature if you want to make side-by-side comparisons. For example, if you are interested only in social media companies, you just click on that tag and you get the full list.

Placing orders

You can use the following order types:

- Market

- Limit

- Stop Loss

- Stop Limit

- Trailing Stop

You can also set good-till-day (GTD) and good-till-canceled (GTC) order terms.

To get a better understanding of these terms, read this overview of order types.

Furthermore, you can find a very usefulestimated cost tab when you place an order.

Alerts and notifications

You can set alerts and push notifications for a large variety of events:

-

Dividend payments

-

Price movements

-

Money transfers

-

Earnings announcements

-

Corporate actions

-

Orders

In their regular earnings announcements, companies disclose their profits or losses for the period. Corporate actions include events like stock splits or corporate mergers.

Portfolio and fee reports

Robinhood's web trading platform has an easy-to-understand portfolio and fee report function. You can view the average cost of and the returns on your stock portfolio. You can also find a pie chart showing how diversified your portfolio is.

Visit broker

Robinhood review

Mobile trading platform

To try the mobile trading platform yourself, visit Robinhood

Compare to its best reviewed alternative: SoFi Invest

The Robinhood mobile platform is one of the best we've tested. It is safe, well designed and user-friendly.

| Pros | Cons |

|---|---|

| • User-friendly | None |

| • Two-step (safer) login | |

| • Good search function |

Robinhood's mobile trading platform isavailable for both iOS and Android devices.We tested it on Android.

The Robinhood mobile platform offers more or less the same design, user experience and functionality as the web trading platform. The research functions are slightly different from the web platform, as the detailed stock screener is not available on mobile.

Robinhood's mobile trading platform provides a safe login. It employstwo-step authentication, including the option to log in using biometric authentication, which is a convenient feature.

Visit broker

Robinhood review

Desktop trading platform

Robinhood doesn't have a desktop trading platform.

Visit broker

Robinhood review

Markets and products

To dig even deeper in markets and products, visit Robinhood

Compare to its best reviewed alternative: SoFi Invest

Robinhood's product portfolio is limited, as it offers only stocks, ETFs, options and cryptos. Furthermore, assets are limited mainly to US markets. During January 2021, Robinhood restricted trading in as many as 50 individual stocks.

| Robinhood | SoFi Invest | Webull | |

|---|---|---|---|

| Stock | Yes | Yes | Yes |

| ETF | Yes | Yes | Yes |

| Forex | No | No | No |

| Fund | No | No | No |

| Bond | No | No | No |

| Options | Yes | No | Yes |

| Futures | No | No | No |

| CFD | No | No | No |

| Crypto | Yes | Yes | Yes |

Robinhood has a good selection of cryptocurrencies, but its stock and ETF product lineups lags behind competitors.

Stocks and ETFs

Robinhood gives you access to around 5,000 stocks and ETFs.The majority of these are listed on major US stock exchanges. You can also find some non-US stocks, which are provided through ADRs rather than indirectly through foreign exchanges.

Usually, we benchmark brokers by comparing how many markets they cover. Robinhood is not transparent in terms of its market range. If you are planning to trade small US stocks or non-US stocks, it is best to contact Robinhood's customer support first.

A further note about low-priced stocks or "penny stocks": these are stocks that have a price of less than $5 and are usually issued by small companies. Penny stocks are more volatile and therefore riskier.

Options

Within options, you can only trade stock and stock index options. These options are available only for bigger stocks.

Cryptos

Robinhood gives you access toa good selection of cryptos . You can trade major cryptocurrencies like Bitcoin or Ethereum, and can follow with real-time data the minor ones like Monero or Stellar.

| Robinhood | SoFi Invest | Webull | |

|---|---|---|---|

| Cryptos (#) | 7 | 4 | 4 |

At the time of our review, cryptos are available in the following 47 states.

| Alabama | Illinois | Missouri | Rhode Island |

| Alaska | Indiana | Montana | South Carolina |

| Arizona | Iowa | Nebraska | South Dakota |

| Arkansas | Kansas | New Jersey | Tennessee |

| California | Kentucky | New Mexico | Texas |

| Colorado | Louisiana | New York | Utah |

| Connecticut | Maine | North Carolina | Vermont |

| Delaware | Maryland | North Dakota | Virginia |

| District of Columbia | Massachusetts | Ohio | Washington |

| Florida | Michigan | Oklahoma | Wisconsin |

| Georgia | Minnesota | Oregon | Wyoming |

| Idaho | Mississippi | Pennsylvania |

Robinhood is planning to expand cryptocurrency trading to more US states.

Robinhood review

Research

To check the available research tools and assets, visit Robinhood

Compare to its best reviewed alternative: SoFi Invest

Robinhood's research tool comes equipped with trading recommendations, quality news, and some fundamental data. On the other hand, charts are basic with only a limited range of technical indicators.

| Pros | Cons |

|---|---|

| • Trading ideas | • Limited interactive charting |

| • Data on asset fundamentals | • No/limited set of analytic tools |

| • Quality news flow |

Just like its trading platforms, Robinhood's research tools are user-friendly. There are slight differences between the tools provided on its mobile and web trading platforms, though. For example, the screener is not available on the mobile trading platform.

If you use the Robinhood Gold service, you can use additional research tools: live market data (level II) and research reports provided by Morningstar.

Trading ideas

You can findanalyst ratings of various productsby experts, which can help you make better investment decisions. These ratings show the percentage of analysts who rate the stock as buy, hold or sell. In the 'People also bought' section, you can find products related to the one you're viewing.

In late February 2020, Robinhood announced a new feature called Profiles,which enables users to customize their public profiles and search other users to see what they have invested in. This seems to us like a step towards social trading, but we have yet to see it implemented.

Fundamental data

You can find some basic fundamental data, such as P/E, number of employees, and market capitalization.

Charting

Charts are really basic at Robinhood. You can view the past price movements of the stock you want to trade, and a few technical indicators are available if you click 'Expand'. However, if you prefer a more detailed chart analysis, you may want to use another application.

News feed

You will find a relevantnews feed when you click on a product. The news feed is high quality, as it is provided by top-tier third parties such as Seeking Alpha or Yahoo! Finance.

Compare research pros and cons

Robinhood review

Customer service

To find customer service contact information details, visit Robinhood

Compare to its best reviewed alternative: SoFi Invest

Robinhood's support team provides relevant information, but there is no phone or chat support.

| Pros | Cons |

|---|---|

| • Fast response time | • No phone support |

| • Relevant answers | • No live chat |

| • No 24/7 support |

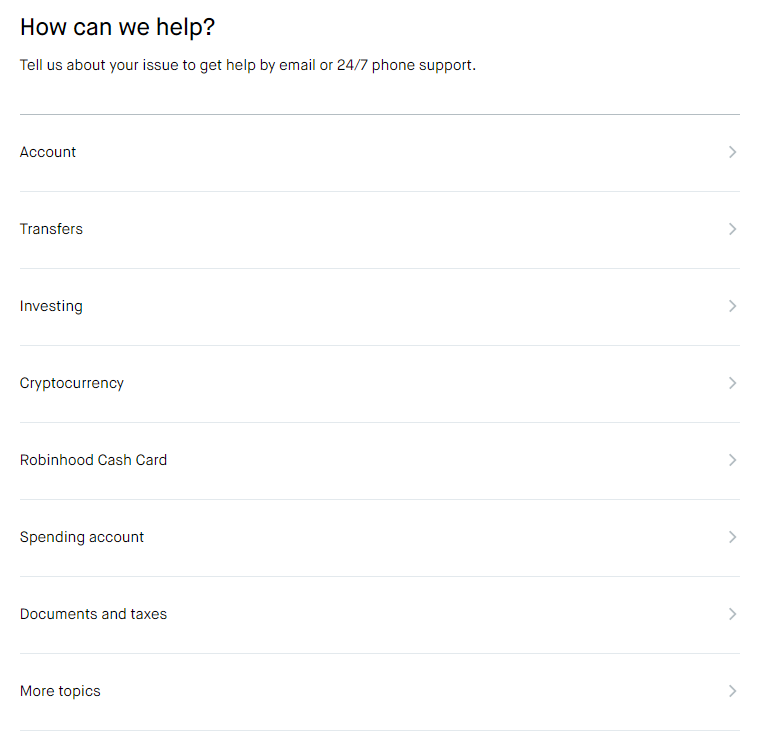

Customer support is Robinhood's weak point, asyou can only contact the support team via e-mail but not telephone or live chat.

When you submit a request, you can choose from topics such as account opening or funding; and the support team will get back to you via e-mail. Once you have picked a topic, you can submit a short description of your problem. Their answer was really helpful and contained all the information we requested. It took less than one day to get a response.

We missed 24/7 support.

Visit broker

Robinhood review

Education

To check the available education material and assets, visit Robinhood

Compare to its best reviewed alternative: SoFi Invest

Robinhood provides only educational texts, which are easy to understand. On the negative side, there are no other useful educational tools such as a demo account or tutorial videos.

| Pros | Cons |

|---|---|

| • Quality educational texts | • No demo account |

| • No trading platform tutorial videos | |

| • No educational videos |

At Robinhood, you can learn from educational articles listed under the 'Learn' tab. The texts are easy to understand, logically structured and useful for beginners.

Visit broker

Robinhood review

Safety

To find out more about safety and regulation, visit Robinhood

Compare to its best reviewed alternative: SoFi Invest

Robinhood is regulated by top-tier authorities, provides strong investor protection, and discloses its financial information. However, the broker doesn't provide negative balance protection and is not listed on any stock exchange.

| Pros | Cons |

|---|---|

| • Majority of clients belong to a top-tier financial authority | • No negative balance protection |

| • High level of investor protection | • Does not hold a banking license |

| • Financial information is publicly available | • Not listed on stock exchange |

Is Robinhood regulated?

Yes, it is regulated by top-tier financial authorities, such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulation Authority (FINRA).

Is Robinhood safe?

To be certain, we highly advise that you check two facts:

- how you are protected if something goes wrong

- what the background of the broker is

How you are protected

There are two major entities within Robinhood: Robinhood Financial LLC and Robinhood Crypto LLC. The former deals with stock and options trading, while the latter is responsible for crypto trading.

Robinhood Financial LLC is a member of FINRA andfalls under the US investor protection scheme, the SIPC. The limit of SIPC protection is $500,000, which includes a $250,000 limit for cash.

Not all investments are protected by SIPC. In general, SIPC covers notes, stocks, bonds, mutual funds and other investment company shares, and other registered securities. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options.

Robinhood Crypto LLC is not a member of FINRA or the SIPC. This meanstrading cryptocurrencies is not protected by any investor protection scheme.

Robinhood does not provide negative balance protection.

Background

Robinhood is a US broker established in 2013 serving clients in the US. The longer track record a broker has, the more proof we have that it has successfully weathered previous financial crises. In this respect, Robinhood is a relative newcomer.

Robinhood is a private company and not listed on any stock exchange. Despite this, itdiscloses its financial statements transparently.

Being a US-regulated broker is a great sign of Robinhood's safety.

Recent events

On July XX 2021, Robinhood has been fined $70 million by FINRA for causing harm to customers, such as serious platform outages or lack of due diligence when customers applied for options trading.

On December 17, 2020, Robinhood has been fined $65 million for misleading customers about how the company makes its revenue from their clients' trades. According to the Securities and Exchange Commission, "Robinhood only partially explained their order flow payment strategy to their customers". This could worsen transparency, as clients could receive higher trade prices without realizing it, while Robinhood is marketed as a commission-free service.

Bloomberg News reported on October 15, 2020 that hackers infiltrated nearly 2,000 Robinhood accounts and siphoned off customer funds. The company has more than 13 million customer accounts. Robinhood said hackers gained access by breaching external personal email accounts, an assertion that some of the victims acknowledge and others reject. We advise readers to use two-factor authentication to minimize such risks.

How does Robinhood make money?

Robinhood makes money from payments for orderflow, membership fees and stock loans.

Find your safe broker

Robinhood review

Bottom line

Visit Robinhood if you are looking for further details and information

Compare to its best reviewed alternative: SoFi Invest

The biggest argument in favor of Robinhood is its appealing fee structure. US stock trading is commission-free and there is no withdrawal or inactivity fee. Robinhood clients can trade on awesome and user-friendly mobile and web trading platforms. The account opening is easy, fast and fully digital.

Robinhood has some drawbacks though. Most of the products you can trade are limited to the US market. Customer support is weak; you can only reach them via e-mail and it can take some time to get an answer. The broker provides educational articles but little else to guide you in the world of trading.

If you want to trade US stocks for free and are looking for an easy-to-use platform, Robinhood is your best choice.

Visit broker

Robinhood review

FAQ

Is It Easy To Withdraw Money From Robinhood

Source: https://brokerchooser.com/broker-reviews/robinhood-review

Posted by: hefnerhationest.blogspot.com

0 Response to "Is It Easy To Withdraw Money From Robinhood"

Post a Comment